PayNow offers an enhanced funds transfer experience that enables consumers and businesses of the participating institutions to instantly send and receive Singapore Dollar funds from one bank or e-wallet account to another in Singapore through the Fast and Secure Transfers (FAST) network by using just their mobile number, Singapore National Registration Identity Card number/Foreign Identification Number (NRIC/FIN), unique business registration number (Unique Entity Number - UEN), or Virtual Payment Address (VPA). The sender no longer needs to know the recipient’s bank or e-wallet provider and account number when transferring money via PayNow.

Launched on 10 July 2017 for participating banks and on 8 February 2021 for participating Non-bank Financial Institutions (NFIs), PayNow is available to consumers and businesses, 24/7, 365 days a year.

As at end 2022:

1. Total Registered Proxies: 7.6M

2. Total Transaction Volume: 311M

3. Total Transaction Value: SGD123B

10 July 2017

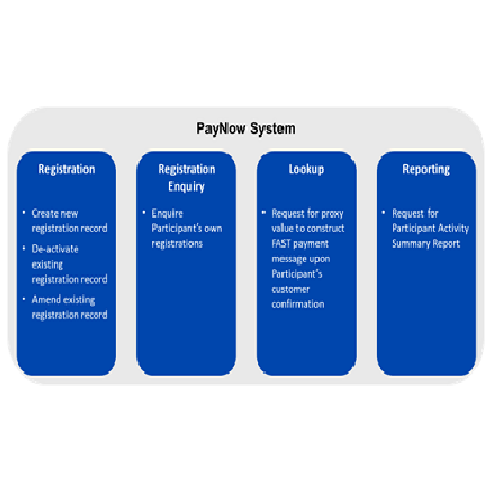

The PayNow System is a depositary of proxies which are mobile numbers, NRIC/FIN, UEN (for companies) and VPA.A PayNowParticipant’s customer can link the account to a proxy, via the PayNow Participant’s platform.

When a PayNowParticipant’s customer uses PayNow to send funds, the PayNow Participant constructs a Lookup Request. The Lookup Request is then sent to the PayNow System and a Lookup Response is generated. Upon obtaining the Lookup Response from the PayNow System, the PayNow Participant populates the account information from the PayNow Lookup Response to initiate funds transfer via payment rails, such as the Fast And Secure Transfers (FAST) or Inter-bank Giro (IBG).

1. Participantconstructs a Lookup Request

2. Participant sends the Lookup Request to PayNow Host

3. PayNow Host receives the Lookup Request and processes the message which will then construct Lookup Response

4. PayNow Host sends the Lookup Response to the Participant

5. Participant receives the Lookup Response and processes the message

ISO standard with Message Queue (MQ) and API interfaces

1. Transaction Per Second (TPS) Violation on Enquiry and Look-Up

2. PayNow Host Availability

3. PayNow Rejection Reasons

1. The Association of Banks in Singapore (ABS) represents the banking industry as the owner of the PayNow Scheme.

2. The Banking Computer Services Pte Ltd (BCS) is the appointed operator of the PayNow system.

3. An ABS PayNow Steering Committee was established to provide governance and oversight for the ongoing operations and development of PayNow.

4. PayNow is governed by Singapore Law.

Depending on the nature of your inquiry, you can contact the Scheme Owner (ABS), Operator (BCS), or the Monetary Authority of Singapore (MAS).

PayNow supports proxy look up for the following use cases.

1. Peer-to-peer fund transfers

banks@abs.org.sg

banks@abs.org.sg

paymentsdev@mas.gov.sg

paymentsdev@mas.gov.sg

Content provided by ICD, Ministry of Electronics & Information Technology, Government of India

Site is designed, developed, hosted and maintained by National E-Governance Division (NeGD)

© 2024, All right reserved @ NeGD under Meity, Government of India